13 Personal Finance Routines That Will Keep Your Home Budget Safe and Secure

Saving money, especially if you’re a big family, can be a pretty challenging task. But, it doesn’t have to be. There are many simple changes you can make to your daily routine that will help secure your home budget. Here are 13 smart personal finance routines that will help you gain control over your finances and keep your home budget safe.

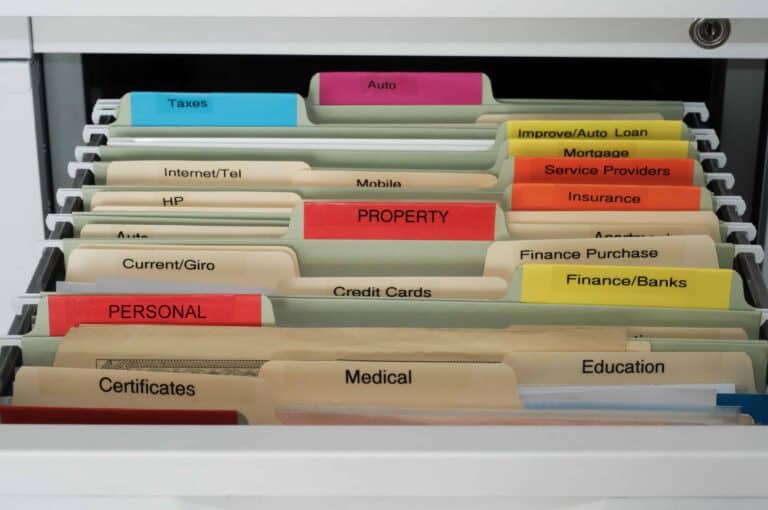

1. Set a Budget

The very first financial routine you should establish, is to set and stick to a budget. You and your family will need to know exactly how much money you have coming in and then determine your fixed and variable expenses. This way you’ll know exactly how much money you can spend each week and how much you can direct towards your savings. Apart from that, take some time to establish your long-term financial goals, such as paying for college, buying a bigger home or retiring early. Then, make a long-term budget to create doable savings and investment routines to make your financial plans come true. Without setting up a budget (and routinely updating it) it is very easy to lose track of your expenses, which may quickly lead to your money being spent unwisely or excessively.

2. Shop With a Shopping List

Another smart routine is to never go shopping without taking inventory of what you already have sitting in your pantry and establishing what you are going to buy. Before you go to the grocery store, make a list of all the things you need, then stick to the list and don’t buy anything else. This will prevent you from buying things you don’t really need and overspending. Stores encourage customers to buy more through limited-time special offers. There is nothing wrong with buying the items on sale, but before you make a decision to buy cross-check your inventory to verify if you really need this particular thing, especially if it is a food item with short expiration date.

3. Sell What You Don’t Need

Instead of throwing away things you don’t use anymore, sell them regularly to make some extra cash. Make it a habit to go through your belongings twice a year, for example during spring and fall cleaning. You can organize a garage sale or sell your stuff on eBay. Not only will you make money on things you don’t need anymore, you’ll also get a chance to declutter. An additional bonus of this routine is that it can be a great bonding experience for your entire family. You can ask your children to help you prepare the sale, post the ads online, or paint the yard sales signs. Ask each of your family members to go though the things they don’t need or want anymore, like clothes or gadgets. Later, you can check them together again, and decide which ones should be sold, or which ones should stay.

4. Eat Out Less

Let’s face it – eating out can quickly drain your budget. Yes, it’s more convenient and sometimes you don’t have time to cook, but it’s also more expensive. Preparing your own meals will allow you to save money and offer your family healthier meals. Preparing meals together is also a perfect way to spend some quality time with your partner and your kids, so do encourage your entire family to participate. That way, a boring chore may turn into a fun family tradition.

5. Plan Your Meals

To make eating at home easier, prepare your meals in advance. You can cook a big batch of family favorite and freeze the extra portions for the days you don’t feel like cooking at all. It is a good idea to get into meal-prepping, which stands for preparing the ingredients you are going to need for weeknight dishes. When you chop the veggies and prepare the meats in advance, every family member will be able to put together a wholesome meal in no time. Doing those routines will be cheaper and healthier than eating fast food or prepackaged dinners.

6. Repair, Reuse, Upcycle

Nowadays, it seems like almost everything can be replaced, but simply buying new things instead of trying to fix the older ones can turn into a very costly habit. Don’t throw away a shirt just because there’s a hole in it. Learn basic sewing skills and repair holes and sew on buttons on your clothes. Got holes in your socks but don’t feel like repairing them? Reuse them! Turn them into sock monkeys – a cheap and cute toy for your kids. Your favorite sweater doesn’t fit you anymore, but you do not feel like parting ways with it? Upcycle it into a soft pillow case. Lots of items in your home can be repurposed or repaired just take the effort to learn basic repair techniques and get cracking.

7. Make Your Own Items

Making sock monkeys is a great start at making toys for your kids instead of buying them. In fact, there are countless things you can make instead of buying. If food items, such as bread and cookies seem too basic for you, try making your own cleaning products. A DIY all-purpose cleaner will cost you under a dollar and you will be able to clean all surfaces in your home with it. Try out different things, such as cosmetics, candles, natural decorations and pick your favorites. Not only will they cost less, but also be a healthier choice for your family.

8. Give Handmade Gifts

Some of the things you DIY can also be given to family and friends as gifts. Making handmade gifts is not only cheaper, but it’s also more thoughtful. The undeniable benefit of creating handmade gifts is that they can be personalized to your liking and they are always one-of-a-kind. There are many different items you can make such as candles, soaps, and various knitted or crocheted gifts.

9. Be Creative With Your Kids

Responsible parenthood involves teaching your children the true value of money. It is important for them to know that having fun does not have to be associated with expensive toys or long-distance trips. Regularly look for new and cheap ways to entertain your kids and to show them that they do not need to have a lot of cash ? what is important are the people they spend time with. Next time, instead of going to the movies or the amusement park, have fun at the park, plant a garden, visit the library or do fun crafts at home.

10. Switch to a healthy lifestyle

This one is pretty simple – if you smoke, you should definitely consider stopping. This nasty habit is great strain on your budget and horrible for your health. Once you stop completely, your wallet and your body will thank you. Establish healthy eating and exercising routines for your entire family, so that you can collectively get fitter, healthier and ultimately happier. Make every family member accountable for the other, so that you will all be able to reach your goals.

11. Stop Using Your Credit Card

If you can’t help yourself and you spend too much money when you’re at the store, simply leave your credit card at home. This way you can focus on buying what you really need and won’t be tempted to splurge on expensive things that won’t bring any value to your life. It is recommended to use your credit card only when you already have the money to pay the balance in full. If you are working on a safe and secure budget, the last thing you need is new consumer debt.

12. Save Energy

Some everyday habits may turn out to be hard to break, but when it comes to lowering your utility bills the rule is simple – turn off what you don’t use. Turn off the lights when you’re not in the room, turn off the TV if you’re not watching it, turn off hot water when brushing your teeth. These simple actions can go a long way when it comes to conserving energy and saving money.

13. Buy in Thrift Stores

Thrift stores offer an abundance of clothing, home accessories, decorations, and other useful items on a dime. Before you go to a shopping mall for a new sweater, visit a thrift store and browse available options. You can buy clothes for just a few dollars and save a small fortune. This is especially good idea for kids? clothes. After all, they outgrow them so quickly.

Final Thoughts

Gaining control of your finances will be easier if you make it a family effort. Involve your kids and teach them valuable lessons about saving money. It may take some time to get used to the above tips once you make them a part of your routine, but it will definitely be worth it.